Tax Benefits

sakunthala Foundation established the NGO to initiate a drive for good and healthy food. It is very clear that over 50% of our organic native seeds have been replaced by hybrid seeds and it’s high time to conserve our native organic seeds.

While every parent in India focuses on giving a bright future to their children, they miss out the fact of gifting a healthy lifestyle to the future generation.

It is very clear that about 50% of our native seeds have been replaced by hybrid seeds and with genetically modified seeds making their appearance, it’s high time we conserve our native organic seeds.

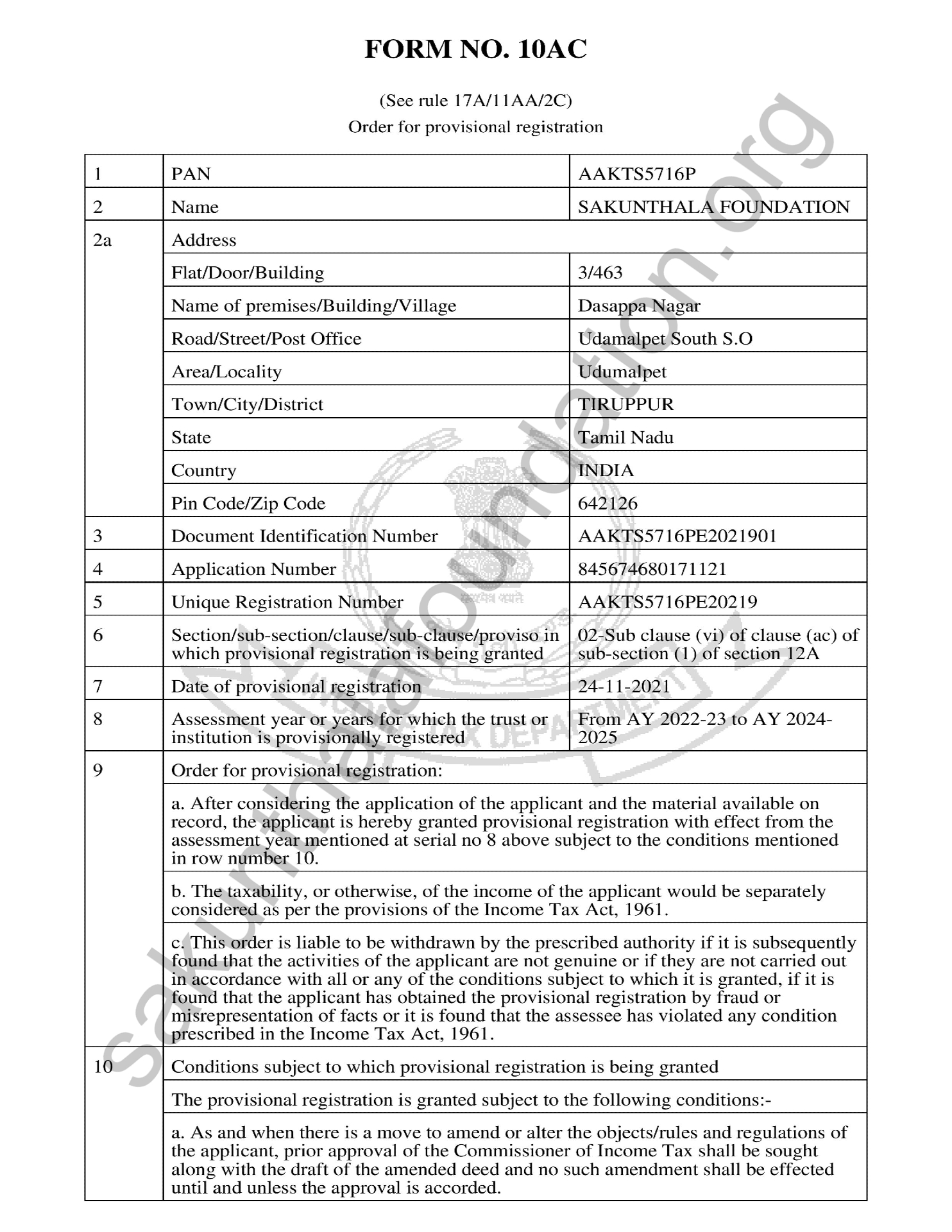

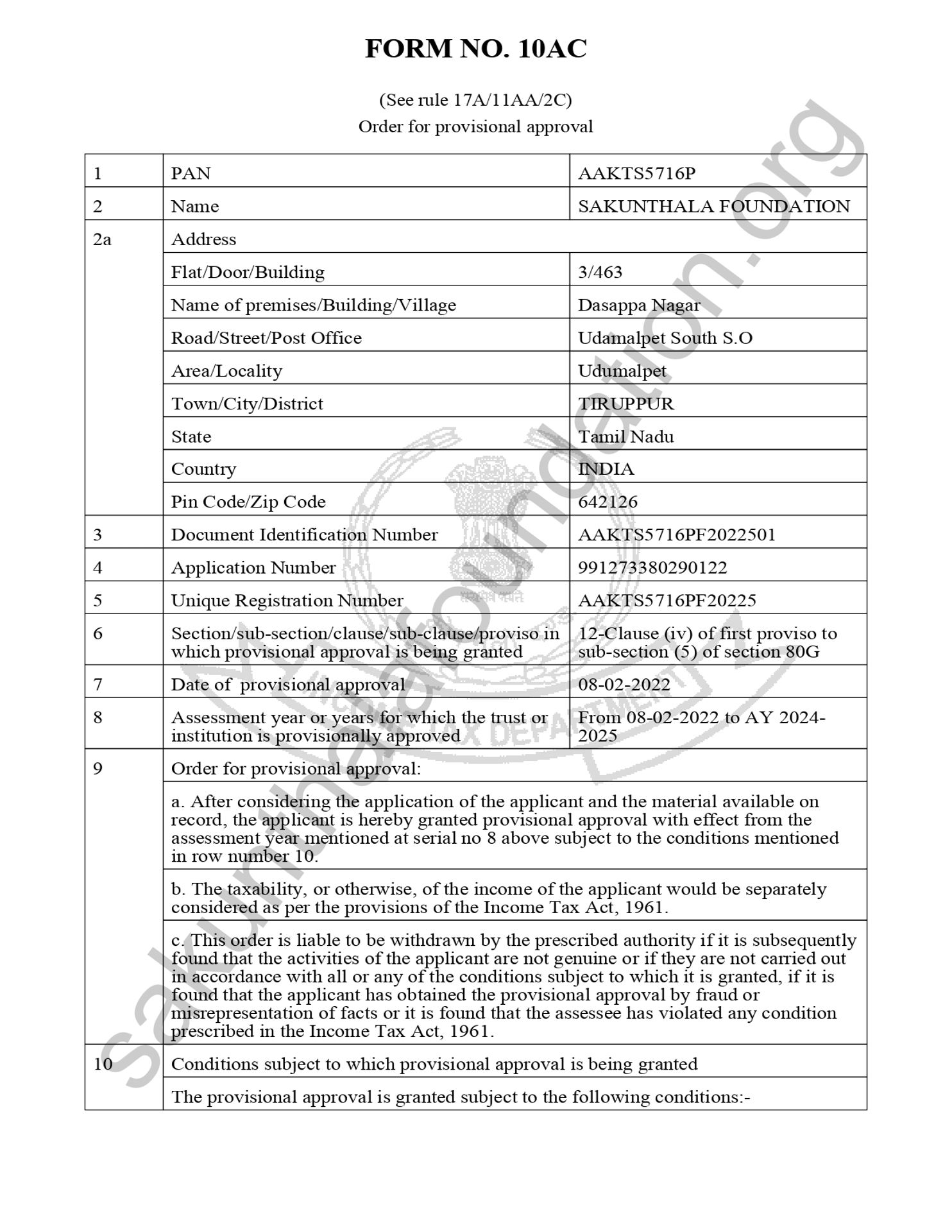

50% tax exemption status under section 80G.

Under the terms of section 501(c) (3) of the Internal Revenue Service Code (US Nationals).

Tax Benefits to Indian Nationals:

While you have an income that makes you liable for taxation, do a noble deed by helping us saving many lives and get a 50% tax exemption on your donation amount under section 80G.

Tax Benefits to Corporate Organizations:

We continuously strive to build a common understanding of the concept of CSR, based on global practices and Indian tradition, provisions of the Indian Companies Act, 2013 by bringing out the key aspects of clause 135 of the Indian Companies Act, 2013 and the recently released draft rules, and highlight its implications. We also focus on guiding funding organizations in strategizing, planning, executing, and monitoring CSR activities.

DARBAN ID = TN/2022/0312414

Donate today ! Help the needy !! While you have an income that makes you liable for taxation, do a noble deed by helping us saving many lives and get a 50% tax exemption on your donation amount under section 80G